not a miniLED though…

but @ $4000 after ecoupon applied… it’s hard for folks to resist to jump into the MEGA Display pool. but, read and check carefully on the specs, especially on the measurement! u may able to acquire, but u may not be able to get delivered.

the first MEGA sized miniLED from PRISM+ goes under $2.5K with ecoupon applied. that(!!!) should send a shockwave to both TCL and HiSense to rethink about their pricing again!

how lowly price can a entry level miniLED display go?

for the moment, PRISM+ is the lowest in the market with e-coupon applied, comes to $2.3K for their biggest model @ 75inch.

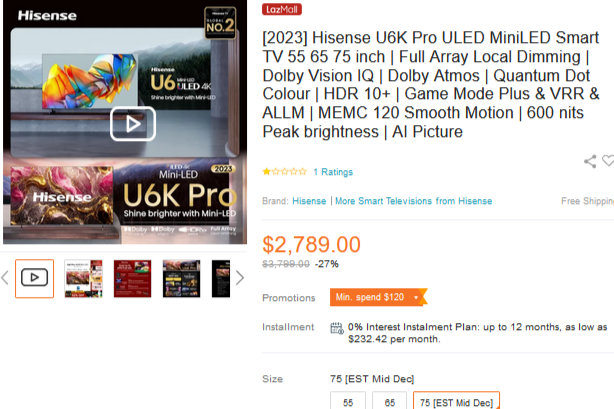

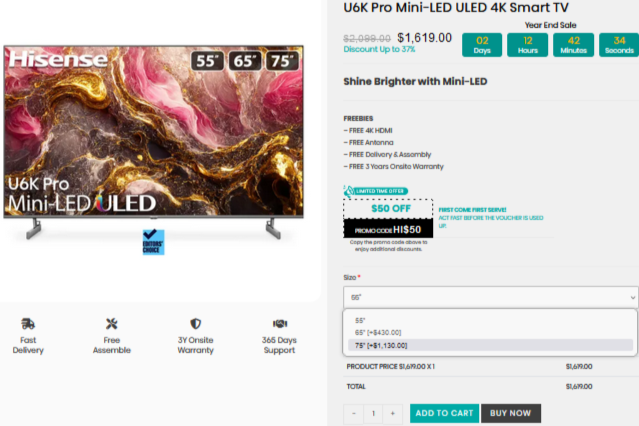

the price from the China’s #2 brand in global market just unveiled their entry model…

…U6K-pro(miniLED variant), $500 more ex than PRISM+.

both comes with quantum dot layer and 3yrs full warranty coverage, but with differences in OS.

so how should a “real” entry level miniLED be priced?

considering that miniLED comes in between typical LED and OLED for the moment, would asking $15/inch*, 2x** for 4K resolution consider justifiable?

hence… without QLED aka Quantum Dot layer treatment, @ 75inch…

75x15*x2** =$2250?

anyway… i expect the price base on per inch specification to go lower, to $12/inch level, as we’re going to step into 2024 in weeks time, considering that miniLED is going to be 5yrs tech?

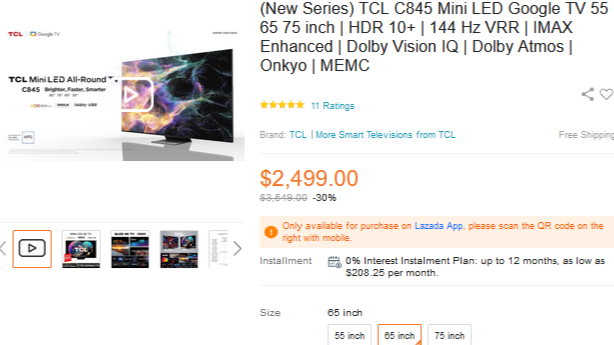

TCL’s latest drop…

…probably getting ready to cut down on inventory stockhold to give way to C755 and C955 upcoming shipments.

$2.5K for 65"(lower by 500)*

$3.4K for 75"(lower by 600)*

*in number, compare to Aussie list price.

the global market can continue to wait…

HiSense pricing in their alternate sales platform is different than their own site-based sales platform.

$2.7k when u applied their discount code upon checkout.

with such price, together with VIDAA OS, PRISM+ “can seat firmly and enjoy the rice vermicelli” on consumer’s interest and sales… if u know what i mean ![]()

is there any other cheaper options that could beat HiSense and PRISM+ in price and close specs?

yes… there is, if Aiwa is willing to employ the D7pro series from ChangHong(who makes Android TVs for Aiwa rebadge) introduced in China’s domestic market April this year, and slap with their own badge.

https://www.zhihu.com/tardis/zm/art/663852389?source_id=1003

https://www.zhihu.com/tardis/zm/art/640970822?source_id=1003

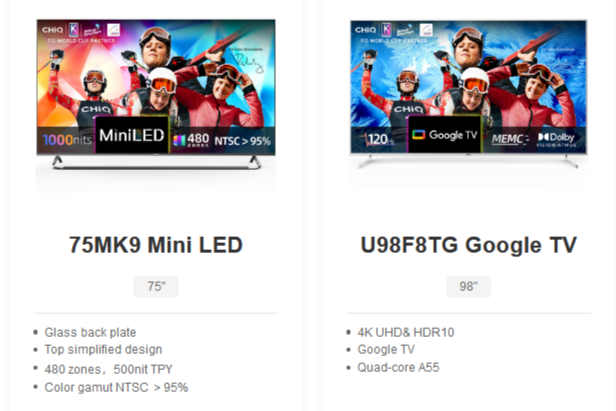

for global market, the miniLED from ChangHong is marketed as CHiQ M9.

presence of Quantum Dot layer is unknown on both models, domestic or global. hence, the price could go lower if both comes without Quantum Dot.

PHILIPS launched mfy’23 miniLED model 9108 in both Taiwanese and Mainland China market. Taiwanese price is very attractive considering that it is able to compete with Mainland Chinese Marques alike like TCL and HiSense…

…if sold here, in a promotional package of 75inch with TAFB1 Fidelio SoundBar that would just cost SGD$3.6K to own!

in Taiwanese market, it seems currently only 2 sizes available. 55inch and 75inch. there isn’t any official PHILIPS Taiwan website to look further into specifications.

in China market, as according to PHILIPS China website…

…only the biggies @ 65, 75, and 85".

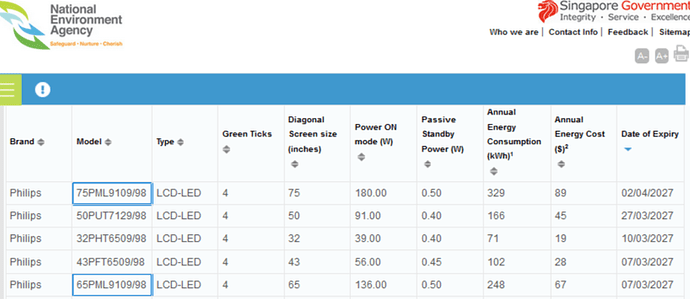

how will PHILIPS SG price the mfy’23 9108 miniLED here is hard to determine. for the moment, there isn’t any indication either thru their website update or NEA/CPSA update listings that shows PHILIPS had submitted the 9108s for assessments.

PHILIPS is not employing MTK SoC in their mfy’23 miniLED TVs, but rather PHILIPS long time and old supplying partner, Novatek SoCs, as revealed here…

…hence, the price should be more competitive to HiSense that comes with MTK, and TCL with RealTek.

in Europe, PHILIPS mfy’23 miniLED comes under 9308 and 9008 model reference. i have no idea whether the “1” of EastAsian market refers to regional distribution reference, or simply something that implies 9108 is a “upgrade” to 9008 on some fields of features or components. but if we’re to pull the price of same sized HiSense U6K(pro) miniLED and U7K to do a cross reference… it would seems that Europe’s 9008 would be a direct competitor to U6K, while 9308 would be taking on U7K.

anyway, let’s hoe that if PHILIPS is launching 9008 here, in consideration that PHILIPS employs TITAN OS(Saphi upgrade), the tagged price would be competitive enough to draw local buyer’s attentions.

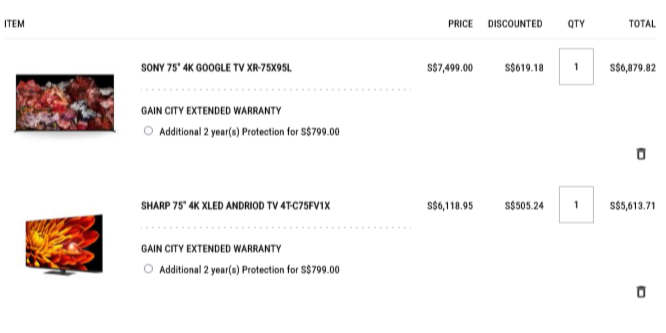

it’s either GainCity’s discount for this festive season is too attractive to their HiSense 75UX or HiSense is locking up on price cuts…

…that makes the competitive SHARP looks very attractive to some buyers.

malaysian XiaoMI fan imported China Domestic Market 85" miniLED TV.

full unbox and hands-on review videos in upload date sequence for ur interest,

if XiaoMI brings the official set in this year, or 3rd party parallel importer brings in.

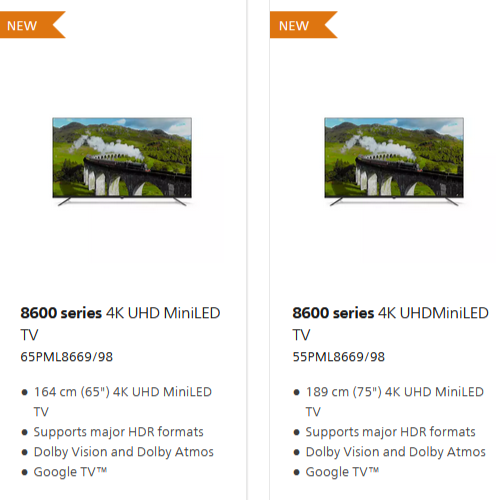

from the recent update of PHILIPS products catalog, there seems to be prominent sign that there will be miniLED TVs from PHILIPS this year. considering that they “show the cards” of what’s coming, there could be probability that samples had sent to NEA for Energy Efficiency and Safety assessment. it’s just that the links to the respective(2 currently) doesn’t seems to be complete and ready for public access.

the 2 models seen so far are allocated in the 8000 range, with 2nd number in reference of “6”. those who followed PHILIPS TV product development should know that the 8000 range is considerably “mid-high” end in PHILIPS TV Family of products, hence it is logical to put the 8000 series along with TCL “C##5” class as well as HiSense “U#@” range of products. for the moment, when u go to PHILIPS SG website, u’ll see only PML8669 product listings as sneak previews. however one of it is confusing as the brief details states 75inch, while the model number indicates as 55inch.

only when they correct or give further updates, then we’re able to confirm if there will be 55inch added with 75inch cancelled, or 75inch to be correct with 55inch cancelled. while HiSense “U” series miniLED will continue to be diverse in 3 reference numbers in overseas market, TCL’s C745 non-miniLED replacement, C755 will be confirmed to have miniLED backlight, no further details on C655 yet.

that should make interested buyers to PHILIPS miniLED TV products wonder, will there be “mid-entry” models to compete with TCL as well as HiSense in terms of specs and price? only further updates to PHILIPS product page will tell… till the end of next week, or months… before annual product wave replacement starts in June.

2 new models updated into PHILIPS catalogue for planned 2024 release.

they’re 65" and 55" of PML8969 that from online comparison, the only difference i can see compared is that the 2 newly updated models comes with native 120hz refresh rate panel, while the 2 PML8669 with “unconfirmed” size will be 60hz native. hence, the probability difference on price will likely be $150~250.

by calling out PHILIPS records of model releases all the way back to 2021 where the last miniLED TV was released, in 2021 a total of 36 models were introduced into local market, 2022 with 23, last year with 25.

currently only 19 were listed as 2024 planned release, which includes the PML8969 above, that leaves 6(reference to last year’s record) probable unknown models to be spread among OLED makes and or with unknown miniLED sizes to battle for attentions from potential buyers from Chinese marques that are competitive in prices.

those who had been following on TCL Xtra-Large display product development, should had known that beside X955 series is to be launch and available locally this year, also includes the C855/805, C755 series.

so far we only see 98X955 taking orders, while 115X955 is ready for order only thru TCL special arrangement. where are the C755 and C855/805? especially when Malaysia expected price was leaked months ago?

an encounter in Malaysia Lazada TCL’s Official Store make me realize where the problem falls.

PRICING!!! how to decide what kind of price to fit local market such that it won’t undercut the attentions and effort they trying to achieve in clearing old stocks!

Malaysia’s price comes close to SGD$8k w/2yrs Warranty.

TCL SG is currently clearing their stockhold of 98C735(2022 model) @ SGD$7.5k w/3yrs Warranty.

let’s say… if TCL SG charges $900* for additional 1yr coverage, would interested buyers be willing to top $1400 for the new model with miniLED… that’s $950 shy from 98X955 that offers even bigger upgrades such as brighter nits, more miniLED diodes, and more dimming zones?

*(reference from COURTS 5yr Warranty package charged on HiSense 100"U7K that INCLUDES initial manufacturer 3yrs complete warranty)

yah… that’s where the problems lies that affects the delay.

anyway… SG market practice for new model launch and replacement always starts from June. that would give TCL a 3mths window for them to send their samples to NEA for Energy Efficiency Assessment as well as stocking up. so… we shall wait and see while probably drooling as Malaysia and HongKong market got their new toys.

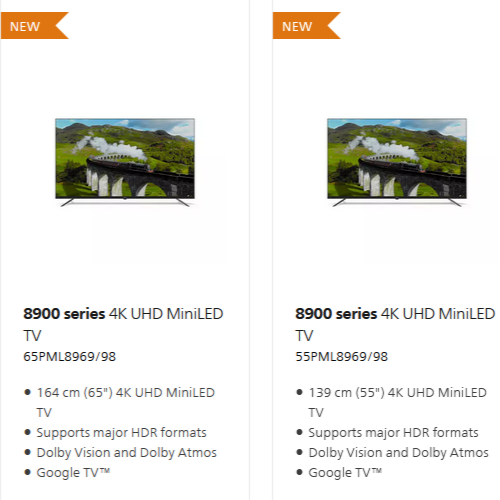

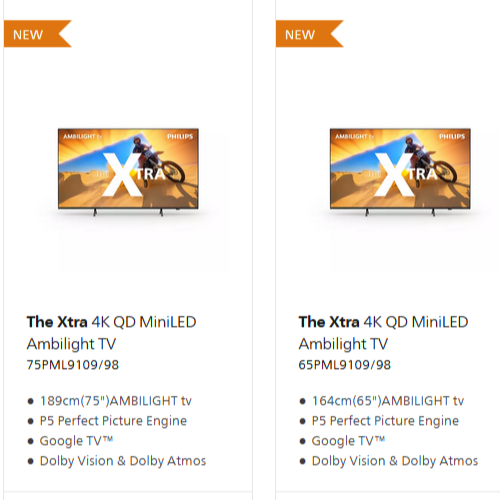

buyers looking forward to higher end PHILIPS miniLED display can look forward for the 9000series this year, after a 3yrs break!

for the moment, this 2 models assessed by NEA is not listed in PHILIPS website yet, so don’t bother to go to PHILIPS website to look for the specs of the models as shown.

for anybody’s interest, u may refer to this Taiwanese page for specification details to see the 2023 model on what improvements was made eversince 2021.

product page is up for the PHILIPS premium 9000series makes, that currently seems to be limited to 2 sizes to replace what was launched 3yrs ago… @ 75 and 65inch.

through the description as well as product details in the page, they keep emphasize on QD-MiniLED but leaves other fields in display specifications not mentioned, such as dimming zones and peak brightness nits.

cross reference of local product leaflet

against Taiwanese product leaflet

the differences is barely noticeable.

so… PHILIPS 9000series QD-MiniLED is out to target which competitor?

certainly they can’t beat TCL’s X955 or HiSense UX series products, unless some crucial specification is highlighted to be competitive. even SHARP’s FV1X series could beat PHILIPS in getting attentions.

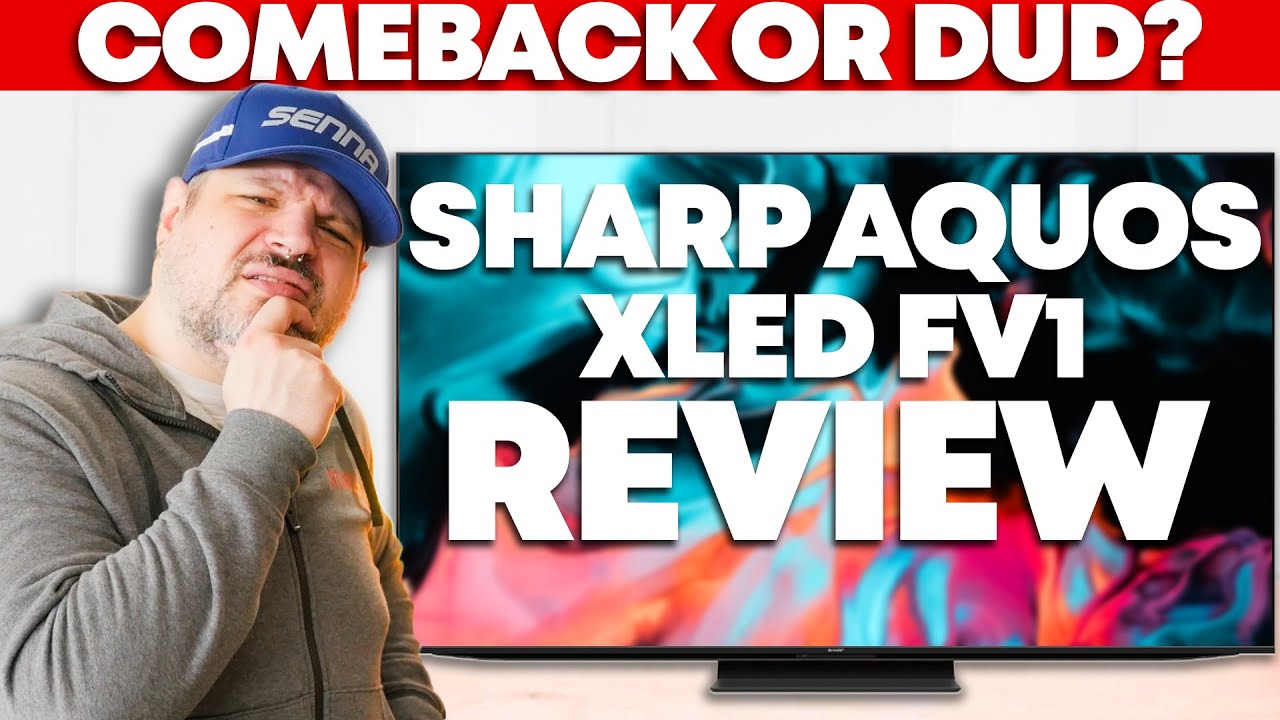

this latest review and probably the last for SHARP…

…shines a light on the imperfection of areas where cause this model to sell very slow.

bad impressions had been highlighted on SHARP’s attempt is bad on their first miniLED product, hopefully their next global rollout this year fine tunes what are imperfect that needs to be corrected.

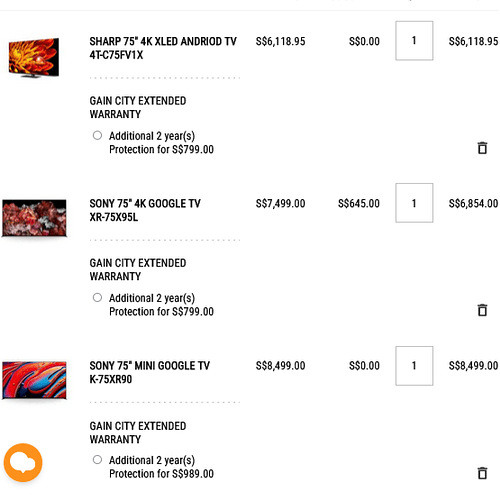

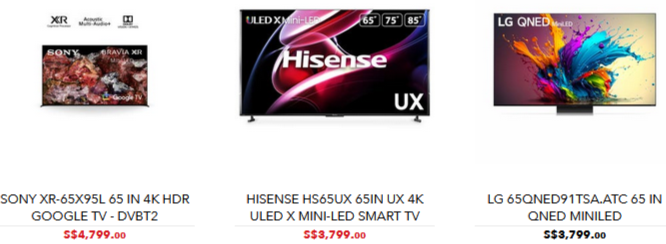

well… the latest “planned/targeted” price is out for SONY’s 2024 highest end Bravia 9 and “clear stock” price cut to SONY’s last year’s model X95L…

…the latest model comes with a “free gift” that would draw some attention, even though the price is high to compete with HiSense 85UX, that’s currently on price cut to clear, but still few hundred dollars more than Sony’s latest 75incher.

SHARP is still holding to their “discounted” price which is 7++ dollars off from initial launch price of $7k. sales movement doesn’t look too bright for SHARP as there would be better options around that could beat their worth.

LG awakes from it’s sleep?

from the screen cap above, u should be able to see that the LG miniLED is an upcoming model, priced to take on SONY XR70 as well as HiSense UX series, where the latter is still undertermined for the moment will there be a 2024 replacement, but assumed to be priced around $4k.

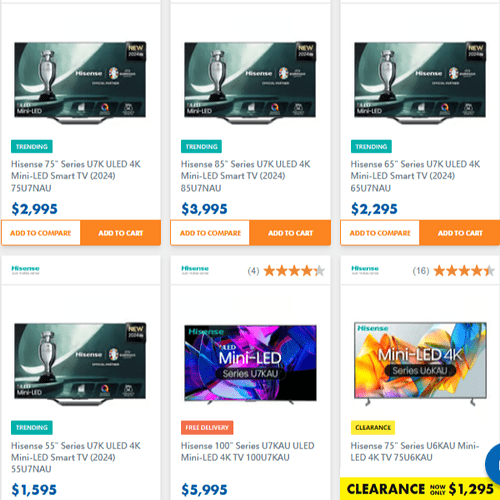

first wave of 2024 HiSense displays reaches Australian shores!

the U7-N series of products should be under assessment now, either in NEA or CPSA, but results is yet to be determined.

the price could seemingly low in Australia, however, it won’t be the same in SG due to low volume import to reflect the market size in SG.

interested buyers had been held hostage in a certain level by the high price unless, bigger competitor like TCL makes a big slash.

CHiQ’;s latest offering in the region…

…first, thru Indonesia where ChangHong products gets good sales responses from buyers seeking entry level budget quality makes.

for the moment, CHiQ products seems to be brought in by a company named Global Approvals. i’ve no idea how does the company relates to Element5, the importer and distributor of CHiQ UST projectors.

their last wave of TV products, were seems to be submitted to NEA & CPSA for assessment in late 2022 for 2023 certification and approval for sale in local market. and then… Global Approvals seems to be not so active on Consumer Displays products, except I.T. Displays.

the only way for CHiQ products to gain wider exposure to buying crowds may probably have to be thru re-badging, then AiWa* comes to mind.

AiWa’s giant sized models, 75/85/98 inchers are all webOS based.

should VV Digital is determined to give local buyers wider choice with the giant sized Android/Google makes, the F8 range from CHiQ would be a good choice. while the M9 on the left of the picture may draw more attentions from PRISM+ lookers as the entry specs of 480 dimming zones for 75inch, would signify lower cost to produce…

*AiWa’s Android/Google OS TVs are mostly made by ChangHong, while their latest waves of webOS TVs are made by brand ownership company back in China known as NPC.

AOC’s latest launch into Taiwan Market.

a low brightness peak 800nit QD-miniLED TV!

below are the general specs in a summary

for start, currently only 55inch is introduced, no idea what are sizes are in the plan to push in to Taiwanese market. @55inch with 2yrs warranty and sold @NTD$20k(approximately SGD$900) average after market price cuts.

in local scene, “last year’s” 2023 models are still in the “launch” state as PHILIPS keeps a very low profile to make AOC TV product “resurgence” into local market after taking a roughly 5~7yrs break. the response had been lukewarm as the “new” AOC TV products with QLED layer with only one model in demo can only be seen in Courts Tampines MEGA Store. with little volume brought in, with little exposure, even if placed among PHILIPS TVs to signify that AOC and PHILIPS comes from the same “mother”, i wonder what was in the mind of TPV/PHILIPS?

should PHILIPS have bigger concerns that their “little brother” would gain more attentions and love from typical conservative consumers, they shouldn’t be. as AOC is known to computer users for their desktop computing display products, not typical TVs. in addition, AOC will have a tougher time to fight with home-brands from the 2 Chinese Giants, iFALCON from TCL, and VIDDA from HiSense, if the latter have plans to bring in.

iFALCON is paralysed for the moment along with distribution rights to SmartTech.

VIDAA is probably in HiSense plan for “budget sector” entry, but likely to put on hold as SG’s market is too small.

so, for the moment, KONKA, CHiQ and OEM brands like AiWa and PRISM+ should be the competitions that PHILIPS should grab attentions from budget buyers with their AOC…